secu_com_finance_2007 <- read.csv("secu_com_finance_2007.csv",

header = TRUE,

stringsAsFactors = FALSE)주성분 분석(PCA)

주성분 분석

REF

http://rfriend.tistory.com/61

차원축소(dimension reduction) : PCA(Principal Component Analysis)

V1 : 총자본순이익율

V2 : 자기자본순이익율

V3 : 자기자본비율

V4 : 부채비율

V5 : 자기자본회전율

# 표준화 변환 (standardization)

secu_com_finance_2007 <- transform(secu_com_finance_2007,

V1_s = scale(V1),

V2_s = scale(V2),

V3_s = scale(V3),

V4_s = scale(V4),

V5_s = scale(V5))V1,V2,V3,V5는 숫자가 클 수록 좋고 V4는 숫자가 클수록 안좋다.

즉, V4의 방향을 변환(표준화된 이후의 max 값에서 표준화된 이후의 관찰값을 뺌)

# 부채비율(V4_s)을 방향(max(V4_s)-V4_s) 변환

secu_com_finance_2007 <- transform(secu_com_finance_2007,

V4_s2 = max(V4_s) - V4_s)# variable selection

secu_com_finance_2007_2 <- secu_com_finance_2007[,c("company", "V1_s", "V2_s", "V3_s", "V4_s2", "V5_s")]# Correlation analysis

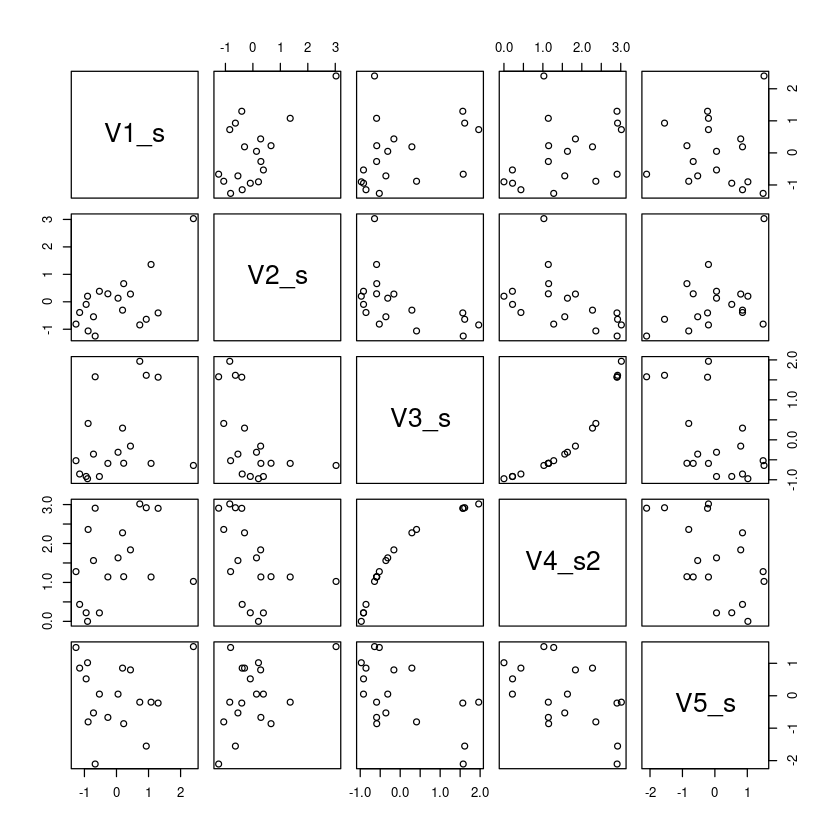

round(cor(secu_com_finance_2007_2[,-1]), digits=3)| V1_s | V2_s | V3_s | V4_s2 | V5_s | |

|---|---|---|---|---|---|

| V1_s | 1.000 | 0.617 | 0.324 | 0.355 | 0.014 |

| V2_s | 0.617 | 1.000 | -0.512 | -0.466 | 0.423 |

| V3_s | 0.324 | -0.512 | 1.000 | 0.937 | -0.563 |

| V4_s2 | 0.355 | -0.466 | 0.937 | 1.000 | -0.540 |

| V5_s | 0.014 | 0.423 | -0.563 | -0.540 | 1.000 |

A matrix: 5 × 5 of type dbl

# Scatter plot matrix

plot(secu_com_finance_2007_2[,-1])

# 주성분분석 PCA(Principal Component Analysis)

secu_prcomp <- prcomp(secu_com_finance_2007_2[,c(2:6)]) # 첫번째 변수 회사명은 빼고 분석

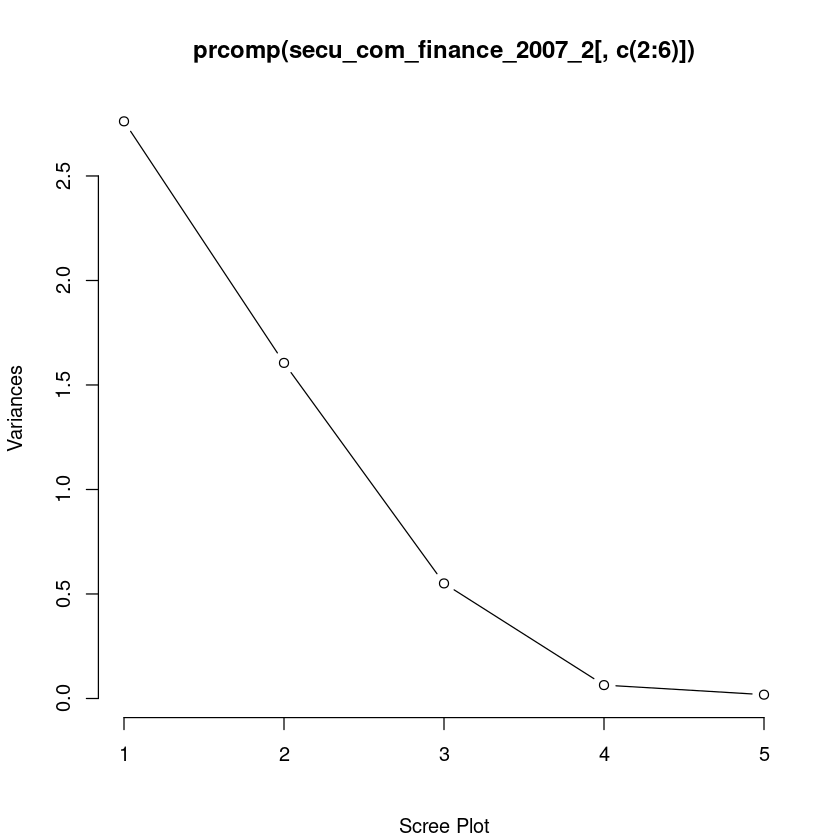

summary(secu_prcomp)Importance of components:

PC1 PC2 PC3 PC4 PC5

Standard deviation 1.6618 1.2671 0.7420 0.25311 0.13512

Proportion of Variance 0.5523 0.3211 0.1101 0.01281 0.00365

Cumulative Proportion 0.5523 0.8734 0.9835 0.99635 1.00000print(secu_prcomp)Standard deviations (1, .., p=5):

[1] 1.6617648 1.2671437 0.7419994 0.2531070 0.1351235

Rotation (n x k) = (5 x 5):

PC1 PC2 PC3 PC4 PC5

V1_s 0.07608427 0.77966993 0.0008915975 0.140755404 0.60540325

V2_s -0.39463007 0.56541218 -0.2953216494 -0.117644166 -0.65078503

V3_s 0.56970191 0.16228156 0.2412221065 0.637721889 -0.42921686

V4_s2 0.55982770 0.19654293 0.2565972887 -0.748094314 -0.14992183

V5_s -0.44778451 0.08636803 0.8881182665 0.003668418 -0.05711464# Scree Plot

plot(prcomp(secu_com_finance_2007_2[,c(2:6)]), type="l",

sub = "Scree Plot")

- 3개 주성분이 적합

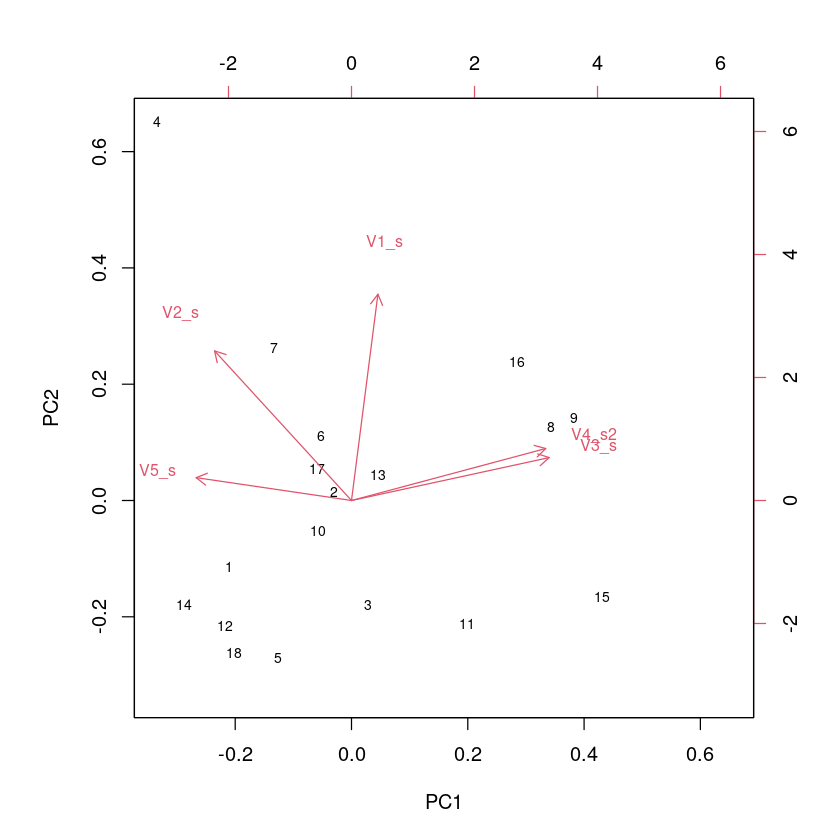

# Biplot

biplot(prcomp(secu_com_finance_2007_2[,c(2:6)]), cex = c(0.7, 0.8))

# 관측치별 주성분1, 주성분2 점수 계산(PC1 score, PC2 score)

secu_pc1 <- predict(secu_prcomp)[,1]

secu_pc2 <- predict(secu_prcomp)[,2]

# 관측치별 이름 매핑(rownames mapping)

text(secu_pc1, secu_pc2, labels = secu_com_finance_2007_2$company, cex = 0.7, pos = 3, col = "blue")ERROR: Error in text.default(secu_pc1, secu_pc2, labels = secu_com_finance_2007_2$company, : invalid string in PangoCairo_Text